florida inheritance tax amount

This means if your mom leaves you 400000 you get 400000 there are no taxes to pay. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 There is no inheritance tax in florida.

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

There is no federal inheritance tax but there is a federal estate tax.

. If someone dies in Florida Florida will not levy a tax on their estate. Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. The tax is levied based on the value of the.

T 727 847-2288 Email. This exemption is a highly politicized issue and in our firm. In addition it can be difficult to calculate the amount of taxes owed after a person dies.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. Just because Florida does not have an inheritance tax does not mean you do not have to file taxes. Think of these as annual.

There is no estate tax in Florida as it was repealed in 2004. Florida Inheritance Tax and Gift Tax. As mentioned Florida does not have a separate inheritance death tax.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from. Federal Estate Taxes. Legislation provides that in 2026 the estate tax exemption threshold will revert to the 2017 level of 549M.

Understanding Inheritance Tax in Florida is essential to properly plan your estate. Florida doesnt collect inheritance tax. What is the Inheritance Tax.

Call us at 813-964-7100. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

For 2016 the gift and estate tax lifetime exemption amount is set to be 545 million. Federal estate tax return. There is however a big US Estate Tax sometimes referred to as the Federal Estate Tax.

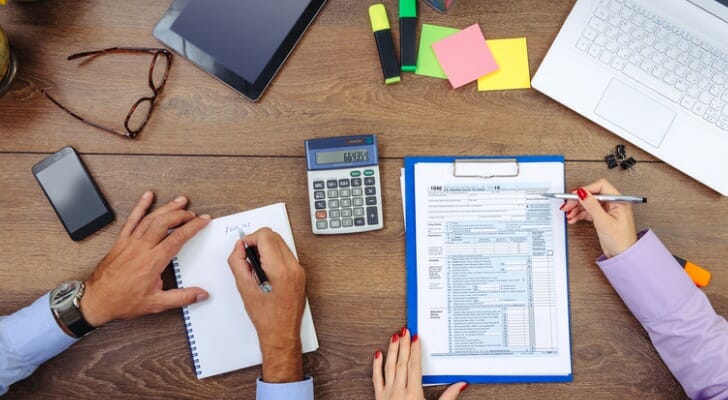

Additionally counties are able to. In 2022 Connecticut estate taxes will range from 116 to 12. There is no inheritance tax or estate tax in Florida.

The inheritance is a tax imposed by some states on an heirs right to receive his or her inheritance. Nonetheless Florida residents may still have to pay inheritance tax when they. The federal government however imposes an estate tax that applies to all United.

Its against the Florida constitution to assess taxes on inheritance no matter how much its worth. There are several other tax filings that the survivor must complete and they include the. Open in Google Maps.

Mintco Financial is an independent Insurance Broker and financial planning will help you with your Life Insurance PlanningEsatte Planning in Florida. Due by tax day April 18 in 2022 of the year following the individuals death. Waller 5332 Main Street New Port Richey Florida 34652.

So whether your rental property is in state or out of state it is considered. The federal estate tax however. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate.

Learn more today from our experienced attorneys. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. Florida does not have an inheritance tax per se.

Florida inheritance tax amount Tuesday April 12 2022 Edit. No Florida estate tax is due for decedents who died on or after January 1 2005. Florida residents may still pay federal estate taxes though.

Federal Estate Tax. If you die in Florida with less than. Proper estate planning can lower the value of an estate such that no or minimal taxes are owed.

Final individual state and federal income tax returns. There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the state level. Florida residents are fortunate in.

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021. The Florida estate tax is different from other states. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Be sure to file the following.

Florida Inheritance Tax Beginner S Guide Alper Law

Taxes In Florida Does The State Impose An Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

State Death Tax Is A Killer The Heritage Foundation

State Estate And Inheritance Taxes Itep

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How Is Tax Liability Calculated Common Tax Questions Answered

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Florida Estate Tax Rules On Estate Inheritance Taxes

Eight Things You Need To Know About The Death Tax Before You Die